Consumer confidence: Favorable job and wage growth boost spending

August 4, 2014

ANN ARBOR—More rapid job creation, higher wages and gains in household wealth have eased the financial strains on households as well as supported more favorable buying plans for vehicles and household durables, according to the Thomson Reuters/University of Michigan Surveys of Consumers.

Conducted by the U-M Institute for Social Research since 1946, the surveys monitor consumer attitudes and expectations.

While consumers considered their current financial situation to now be in the best shape since the start of the Great Recession, those gains have not caused consumers to confidently expect a continuation of robust growth in the year ahead, said U-M economist Richard Curtin, who directs the surveys. View and download the chart and table (Excel files).

Nonetheless, confidence is sufficiently high to expand consumption by an annual rate of 2.5 percent in 2014.

Click image for larger view

“Despite the recent gains in jobs and wages, consumers have yet to interpret these gains as an indication that more robust growth in jobs and wages will be forthcoming in the future,” Curtin said. “The slow and uneven pace of the recovery in jobs and incomes during the past five years has made consumers unwilling to put much stock in favorable economic forecasts until repeatedly confirmed by positive realizations.

“What may have been termed a skeptical viewpoint in an earlier era, is now regarded as a more practical ‘show-me’ state of mind. This show-me attitude is particularly strong among moderate income families and middle-aged householders.”

Current Finances Improve

When consumers were asked to explain in their own words how their financial situation had changed, one-in-three households mentioned that their income had recently increased. While more work meant higher incomes, the gains were also due to higher wages. This was the most positive assessment of current income trends since the May 2007 survey.

Complaints about higher prices, however, also rose, cited by one-in-five households in July. Unfortunately, the recent gains did not prompt more consumers to expect higher income gains in the year ahead, Curtin said. Just over one-in-four anticipated being better off financially, with half expecting no income gain at all.

Housing Market Slows

The slowdown in home price appreciation and uptick in inflation has had a significant impact on home sales. The median annual increase in home values expected by homeowners was just 0.4 percent in the July survey, well below the expected inflation rate.

Although a resurgent housing market has been an important factor for recoveries in the past, investments in homes are no longer expected to post strong inflation-adjusted gains, Curtin said. This leaves housing demand more vulnerable to even small changes in the pace of home appreciation and the inflation rate.

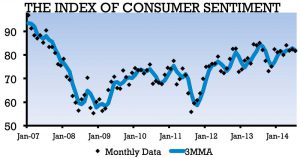

Consumer Sentiment Index

The Sentiment Index was 81.8 in the July 2014 survey, slightly below the 82.5 in June and the 85.1 recorded last July. During the first half of 2014, the Sentiment Index remained remarkably stable, averaging 81.9, with the July figure nearly identical to that average. Current Conditions Index was 97.4, up from June’s 96.6, while the Expectations Index slid to 71.8 from 73.5 in June and 76.5 last July.

About the Survey

Richard Curtin (Photo by D.C. Goings)

The Survey of Consumers is a rotating panel survey based on a nationally representative sample that gives each household in the coterminous U.S. an equal probability of being selected. Interviews are conducted throughout the month by telephone. The minimum monthly change required for significance at the 95% level in the Sentiment Index is 4.8 points; for Current and Expectations Index the minimum is 6.0 points. For more information, visit the Surveys of Consumers website at http://press.sca.isr.umich.edu.

The Survey of Consumers is a rotating panel survey based on a nationally representative sample that gives each household in the coterminous U.S. an equal probability of being selected. Interviews are conducted throughout the month by telephone. The minimum monthly change required for significance at the 95% level in the Sentiment Index is 4.8 points; for Current and Expectations Index the minimum is 6.0 points. For more information, visit the Surveys of Consumers website at http://press.sca.isr.umich.edu.

Watch a video about the survey:

Contact:

[email protected] or

Surveys of Consumers, (734) 763-5224 or

Thomson Reuters PR Hotline, (646) 223-7222, ext.1